Another great EconTalk podcast, this time a discussion with Alan Meltzer of CMU, a leading expert on monetary policy and the history of the Federal Reserve, and a confidante of officials like Alan Greenspan.

At about minute 45 of the podcast we are treated to a revealing 10 minute dialog between Meltzer, a member of the cult of Efficient Markets (EM), and recovering cult member Russ Roberts (host of EconTalk and GMU econ professor), who is starting to realize that reality diverges from the teachings of the cult. Meltzer's thesis is that reckless behavior by bank executives was largely driven by expectations that they would be bailed out in case of disaster. He claims this crisis was caused by moral hazard and the banksters knew full well the risks they were taking. (And the pension funds and sovereign wealth funds that also bought the toxic stuff? Were they expecting a bailout too?) Russ wonders whether top executives really understood the structured finance of mortgages, perhaps neglected fat tail events, perhaps were irrationally overconfident. Roberts' points sound very "behavioral" and not at all EM.

Meltzer cannot bear to admit that the market is not all-knowing. Throughout most of the podcast he steadfastly maintains that current share prices of banks give an implicit (and more accurate than any other) valuation of the complex mortgage securities on their books. This is about as nutty as the thinking that got us into the crisis in the first place! The markets have been valuing CDO tranches from the beginning; why did they get it so wrong for so long? Now people trading bank equity have got it right? (How many are just gambling on probabilities of different rescue / nationalization outcomes?) Meltzer even mentions that the Fed rescue of LTCM was a source of moral hazard, neglecting the fact that the investors and principals were completely wiped out in the rescue.

Russ has made great progress in his thinking during the last few years of doing EconTalk interviews. It's a tribute to his intellectual honesty and common sense that he can, at this advanced age, overcome the conditioning he received from his education within the Chicago EM cult. Most cult members are more like Meltzer. He cannot abandon the faith, even in the face of a market failure of these historical proportions.

But of course it is Meltzer I see on national TV, holding forth with utter certainty on the crisis. For some reason it is he, not Russ, who gets to make expert predictions.

Pessimism of the Intellect, Optimism of the Will Favorite posts | Manifold podcast | Twitter: @hsu_steve

Wednesday, February 25, 2009

Trento talk

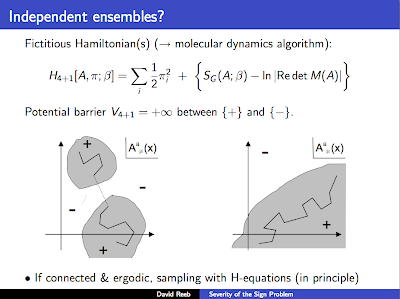

My student David Reeb will be attending this meeting at ECT Trento next week:

Sign Problems and Complex Actions

workshop at ECT* Trento

Monday March 2 - Friday March 6 2009

organizers: Gert Aarts (Swansea University) & Shailesh Chandrasekharan (Duke University)

I would really have liked to go but my wife is giving a talk at Emory at the same time so I am stuck at home watching the twins. No Alps for me :-/

Here are the excellent slides for David's talk. The first section is a nice introduction to Monte Carlo methods in quantum field theory, which he made for a local seminar here in the ITS (for non-experts).

Innovation competitiveness

An interesting new report on innovation competitiveness. Click below for some summary statistics and rankings. The US placed 6th overall. The countries ranked higher tend to be small (e.g., Sweden, Denmark), with the exception of S. Korea. The report also gives "change scores" in each category -- essentially, the first derivative calculated over 1999-2005 -- that indicate who is gaining on whom.

The authors normalize most statistics to national GDP or population, which gives a more realistic picture of smaller countries than just looking at aggregate numbers. Some figures seem quite misleading. For example, Russia ranks number one in Higher Education with over 50% of the population completing tertiary education, whereas Germany ranks only 18 with 22%. But I suspect the level of training and human capital is much higher in Germany. Similarly, rankings of venture capital invested relative to GDP probably overstate the impact of government-backed funds in many smaller countries which lack a long history of venture investing. Some tables of interest in the report include corporate and government-funded R&D relative to GDP, GDP per capita and productivity per capita.

The overall conclusion of the report is that the US is in a strong position, but that others are catching up fast.

The authors normalize most statistics to national GDP or population, which gives a more realistic picture of smaller countries than just looking at aggregate numbers. Some figures seem quite misleading. For example, Russia ranks number one in Higher Education with over 50% of the population completing tertiary education, whereas Germany ranks only 18 with 22%. But I suspect the level of training and human capital is much higher in Germany. Similarly, rankings of venture capital invested relative to GDP probably overstate the impact of government-backed funds in many smaller countries which lack a long history of venture investing. Some tables of interest in the report include corporate and government-funded R&D relative to GDP, GDP per capita and productivity per capita.

The overall conclusion of the report is that the US is in a strong position, but that others are catching up fast.

Monday, February 23, 2009

Macro graphs

Some interesting graphs from Danny Quah, head of the LSE economics department. Note the US trade deficit is almost as big as India's entire economy!

I also recommend the talk below on Chinese economic development, although it is a bit long.

Two slides from the talk. Note Japan's largest trading partner is China, and China's largest trading partner is greater E and SE Asia.

I also recommend the talk below on Chinese economic development, although it is a bit long.

The Shifting Distribution of World Economic Activity: China and global imbalance

Speaker: Professor Danny Quah

China has, single-handedly, brought more people out of poverty than the rest of the world combined, and faster than anywhere else has been able to achieve. How can this continue?

Danny Quah is professor of economics and head of the Department of Economics at LSE.

Two slides from the talk. Note Japan's largest trading partner is China, and China's largest trading partner is greater E and SE Asia.

Sunday, February 22, 2009

David X. Li

I've been seeing a lot of hits from searches on "Gaussian Copula" or "David X. Li" lately. Li is a quant who developed the Gaussian Copula model used in pricing of CDOs. See here for a post I did on him and the model back in 2005, including some predictions that it might all end in tears :-/

David X. Li is no relation to David X. Cohen of the Simpsons and Futurama, although Cohen did study physics at Harvard :-)

Below is some advice for quants from Li.

David X. Li is no relation to David X. Cohen of the Simpsons and Futurama, although Cohen did study physics at Harvard :-)

Below is some advice for quants from Li.

How to Become a Successful Financial Engineer?

David X. Li

Actuaries might have been the most quantitative people in the financial industry for a long time. However this unique position has been severely challenged since about a decade or two ago when the investment banks began to hire so-called "rocket scientists" – people with Ph.D. degree in physics and other quantitative fields. Nowadays you can find quantitative analysts or "quants" working in various functions in investment banks and large commercial banks, such as trading, risk management and portfolio management. You may even meet some quants working in some traditional quant-free zones, such as auditing department of a large bank. As the insurance and banking businesses converge it is hard to imagine that traditional approaches to risk measurement – like actuaries work on the insurance side and quants work on the banking side – can still be applied in isolation.

This change poses a challenge to our profession. However there is nothing to panic about. Many problems in practice might need combined skills in actuarial science and financial engineering to solve.

This article outlines some basic skills people should have in order to become a successful financial engineer. It is more from an investment bank angle since that is where the author knows the most.

Mathematical Training

Karl Marx once said ``A subject can only become a science after it successfully uses mathematics". Finance might be the most successful area to use mathematics. The mathematics used in finance ranges from basic mathematics, such as numerical analysis, calculus, and statistics to more advanced ones, stochastic processes and stochastic differential equations, non-linear optimization etc. The areas we use the most in practice are numerical analysis and statistics. Whoever wants to have a career as financial engineer should try to have a solid training in mathematics in school. Wall Street tends to hire people with strong quantitative skills. The general philosophy is that we can teach you finance, but we don’t have time to teach you mathematics. We use a lot of mathematics at the graduate level, so it is to your advantage to take some graduate mathematics courses before you walk out of school. Many practitioners go back to school to learn more mathematics after a few years working in industry. It is hard to learn all the necessary mathematics, but you can pick up other useful mathematical tools or concepts once you have built a solid foundation. I like the saying by Professor Elias Shiu at the University of Iowa "Learning Mathematics is like rowing, if you don’t push forward you’d be pushed backward". Just keep rowing!

On the other hand, don’t indulge yourself into abstract mathematics. Mathematics is just a tool. So you should keep the mentality of an applied mathematician. We find it usually takes longer time for a pure mathematician to feel his "role" in practice than a physicist or an applied mathematician. One famous applied mathematician once said, "Mathematics in every one of its applied areas is a good servant, but a bad master". At the end we are to solve practical problems, not a mathematical game or theorem.

Financial Training

The theory of finance has emerged as a prominent science with the Nobel Prize award to Harry Markowitz, William Sharpe, Merton Miller, Robert Merton and Myron Scholes. This theory attempts to understand how financial markets work, how to make them more efficient, and how they should be regulated. These revolutionary theories in the latter half of the twentieth century have created waves of financial innovation in Wall Street. There are essentially two revolutions. The first revolution, which was the introduction of quantitative methods to the black art of equity fund management, began with the 1952 publication of his Ph.D. dissertation ``Portfolio Selection" by Harry Markowitz. The second revolution in finance began with the 1973 publication of the solution by Fischer Black and Myron Scholes (in consultation with Robert Merton) to the option pricing problem. The Black-Scholes formula brought to the finance industry the modern methodology of martingales and stochastic calculus, methodology which enables investment banks to produce, price and hedge an endless variety of "derivative securities."

There are mainly two aspects of the financial theory, economic and engineering. At the early stage it is essential to understand each instruments from an engineering point of view. But you will find it is important to understand the "big picture" or the economic aspect of the theory later on. There are many books on derivative securities. The key is to fully understand each instrument thoroughly. A good reference book is John Hull’s book. Another important aspect is to understand the market conventions, which you can only learn from a practitioner’s book or some software manuals. These conventions are very important since a one-day miscount could result in a 40-bp (basis point) difference, which is usually larger than many derivative transaction profit margins.

IT Training

Computers have played an important role in our daily life, more so in the life of a financial engineer. Of course you can rely on the IT people in your company to implement your models. But it usually takes a longer time for you to explain the problem than if you just write something simple and get the answer yourself. The package people use the most is the Excel spreadsheet. Other packages, which allow you to do rapid development, are MatLab, Mathematica or Splus. If you can program in C++, Visual Basic for Application or Java, that will be even better. You should pick up these skills at the early stage of your career, which will make your life much easier later on.

In summary, you need a combined set of skills to be a successful financial engineer. Many skills could be developed while you are still in college. Just keep in mind, financial engineering skills is just one set of skills for you to be successful in your business life. Many other skills, such as communication skills and leadership, may play a more important role in your career.

David X. Li is a partner in the RiskMetrics Group where he concentrates on risk management research, product development and structural marketing. Previously he worked for banks in the areas of risk management and credit derivative trading. He taught actuarial science and finance at university briefly before he left academia. Mr. Li has a Ph. D. degree in statistics from the University of Waterloo and master's degrees in economics, finance and actuarial science from the famous NanKai. He is an Associate of the Society of Actuaries (SOA) and an elected Council Member of the Investment Section of the SOA.

Saturday, February 21, 2009

Demand destruction

There is no way government stimulus can replace the trillions of dollars of debt driven demand that the US and world economy have relied on for years. What's ahead? See here for some very good, but very gloomy, analysis. (Earlier related post here -- see Microsoft CEO Balmer's comment.)

Let's hope we don't go the way of Japan:

NYTimes: As recession-wary Americans adapt to a new frugality, Japan offers a peek at how thrift can take lasting hold of a consumer society, to disastrous effect.

The economic malaise that plagued Japan from the 1990s until the early 2000s brought stunted wages and depressed stock prices, turning free-spending consumers into misers and making them dead weight on Japan’s economy.

Today, years after the recovery, even well-off Japanese households use old bath water to do laundry, a popular way to save on utility bills. Sales of whiskey, the favorite drink among moneyed Tokyoites in the booming ’80s, have fallen to a fifth of their peak. And the nation is losing interest in cars; sales have fallen by half since 1990.

Friday, February 20, 2009

Netbooks and tipping points

Anyone using a netbook? About 6 years ago I had a tiny Sony Vaio with a 9 inch screen that I loved. Ultimately I couldn't stand XP anymore and switched to a Mac once OS X took off, but I always thought the form factor was great. At the time, only Japanese consumers would tolerate such a small screen and keyboard.

Now netbooks, which look just like my old Sony, are the hottest thing, accounting for about 10 percent of unit laptop sales. They can sell for under $300 and often run Linux distros like Ubuntu.

What I haven't seen discussed is that the rise of the netbook represents a new phenomenon -- a successful product category pioneered by the anonymous Taiwanese hardware companies that do the contract design and manufacturing for virtually all laptops these days (including for Apple). Until now, it's been US and Japanese companies doing the branding and marketing and capturing the largest chunk of profits. But netbooks were conceived and pushed by companies like Asustek and MSI that are virtually unknown except to computer geeks. Initial interest from big US companies like Dell and HP was limited, and the category took off in Asia and Europe before catching on here.

This may be a tipping point for the technology value chain, in which the uncontested hold the Taiwanese have on laptop and motherboard technology starts to be manifested in product category and brand innovation.

Heritability of brain structure

The following paper has some beautiful figures, including the one below illustrating the heritability of physical brain structure based on MRI studies of twins.

Click for larger image, or look at the actual paper. From the figure caption, which is quite long:

Neurobiology of Intelligence: Science and Ethics

Jeremy Gray1 and Paul Thompson2

1Yale University, and

2University of California, Los Angeles

Review Paper, Nature Reviews Neuroscience 5:1-13, June 2004, published online, May 19 2004.

Human mental abilities, such as intelligence, are complex and profoundly important, both in a practical sense and for what they imply about the human condition. Understanding these abilities in mechanistic terms has the potential to facilitate their enhancement. There is strong evidence that the lateral prefrontal cortex supports intelligent behaviour. Variations in intelligence and brain structure are heritable, but are also impacted by factors such as education, and prenatal and family environments. The empirical convergence of cognitive, social, psychometric, genetic, and neuroimaging studies of intelligence is scientifically exciting, but raises important ethical questions. If these are not addressed, further empirical advances might be compromised.

Click for larger image, or look at the actual paper. From the figure caption, which is quite long:

Figure 3 |Linking genes, brain structure and intelligence. a| Genetic influences on intelligence have been assessed directly (top arrow). The consensus of many studies is that at least 40% of the variability in general cognitive ability (g) can be attributed to genetic factors89. Gene effects on brain structure can be assessed by collecting MRI brain scans (left) from twins or extended families, and comparing volumes of grey matter (green), white matter (red) or cerebrospinal fluid (blue). Overall brain volume is 85% heritable34and correlates with psychometric intelligence (0.33) (REF.30). ...The volume of grey matter in each lobe is genetically influenced to different degrees (the volume of grey matter in the frontal lobe, shown at right in yellow and pink, is highly heritable). b| Genetic influences on brain structure can be assessed using statistical maps. In the classical twin design, a feature is heritable if within-pair correlations (typically called intraclass correlations) are higher for pairs of identical twins (who share all their genes, except for rare somatic mutations) and lower for same-sex fraternal twin pairs (who, on average, share half their genes). To better understand genetic influences on brain structure, correlations are shown for regional grey matter volumes in sets of identical (monozygotic (MZ)) and fraternal (dizygotic (DZ)) twins. These correlations vary across the brain surface (red, highly correlated; blue, less well correlated). The structure of the brains of identical twins is more similar than that of fraternal twins. ...Variations in grey matter volumes are strongly influenced by genetic factors, especially in frontal brain regions (for example, the dorsolateral prefrontal cortex). A subsequent study in a larger, independent sample34found that variations in total grey matter volume were almost entirely attributable to genetic factors... These genetically mediated differences in brain structure explain a proportion of the variation in general cognitive ability. This ability is also influenced by non-genetic factors such as education and nutrition97,151, prenatal and family environments, training35and environmental hazards such as lead poisoning.

Wednesday, February 18, 2009

Race and IQ in Nature

I wouldn't touch this with a 10 foot pole, but Nature did here (sort of), as part of its Darwin 200 celebration. (Via Razib.)

The ensuing online debate is as polarized as you might expect. Read James Flynn's comment, which utterly demolishes Steven Rose.

I predict most readers will find about half the remarks in the debate incredibly stupid. But which half? :-)

Incidentally, one of the commentary authors and I were both on the faculty at Yale at the same time and I have known her for many years.

My Darwin 200 post is here, but see also this ;-)

In this, the second of two opposing commentaries, Stephen Ceci and Wendy M. Williams argue that such research is both morally defensible and important for the pursuit of truth. In the first, Steven Rose argues that studies investigating possible links between race, gender and intelligence do no good.

The ensuing online debate is as polarized as you might expect. Read James Flynn's comment, which utterly demolishes Steven Rose.

Flynn: ...In Rose’s original paper [commentary], he asserts that the trait in question (intelligence) leaves aside other desirable traits and argues that the groups in question can be divided into subgroups that are more biologically coherent. He concludes that the hypothesis is not subject to scientific treatment; and therefore, no useful social policy will emerge. In his response to Ceci and Williams, he says something very different, namely, that by about 1975, it had been definitively shown that genes had no place in explaining group differences. So from that date, Jensen and everybody else had no excuse to persist.

To assert both that a hypothesis is not scientifically testable and that it has been conclusively falsified is incoherent. The only way to reconcile them is to assume that Rose does not really mean Jensen had been refuted by 1975, but is saying that by that date, it should have been clear to everyone that the question was indeed unanswerable.

I predict most readers will find about half the remarks in the debate incredibly stupid. But which half? :-)

Incidentally, one of the commentary authors and I were both on the faculty at Yale at the same time and I have known her for many years.

My Darwin 200 post is here, but see also this ;-)

Tuesday, February 17, 2009

Bhide, innovation and basic research

I highly recommend this podcast interview with Amar Bhide at Columbia Business School. Bhide studies entrepreneurship and has a very good understanding of how business innovation actually works. (This is quite rare for an academic -- even those in economics departments or business schools.)

The whole podcast is worthwhile, but particularly the last 25 minutes (starting at about minute 40), in which Bhide discusses Schumpeterian vs Hayekian models of innovation, Knightian uncertainty, securitization and the financial crisis.

I would fault Bhide in one area: the catchy point of his recent book is that high level scientific breakthroughs (e.g., Archimedes' Principle of buoyancy) rapidly become public goods, whereas the nitty gritty skills and know-how necessary to create a useful product (e.g., shipbuilding) are more readily localized and the real source of competitive advantage. He focuses on small optimizations of existing technology to solve everyday problems; it's true that this is the more common type of innovation. But he neglects how whole new industries are sometimes created by real technological breakthroughs.

To take a particular example, look at the Fairchild Semiconductor guys. They weren't just average engineers -- they were trained in advanced labs and hired by the guy who actually invented the transistor (Shockley). It's no coincidence that the country that paid for the basic R&D went on to invent and capture the semiconductor industry. Of course, it was also necessary to have venture capital (actually, they sort of invented it), big capital markets and proximity to customers. But Bhide sounds like he wants to leave out the R&D aspect -- that can be done anywhere, he says. Yes, it can be done anywhere, but the commercialization is more likely to happen nearby, as long as the other necessary factors are also available. I could tell a similar story about biotech or internet companies in the bay area.

Basic research tends to be underfunded primarily because the inventor seldom captures the lion's share of future returns. This makes it less appealing to private investors compared to small optimizations (applications of existing technology) which lead more directly to products and profits. Therefore, funding for basic research must come from the public sector. Societies typically spend too little rather than too much, as future returns are diffuse and have no singular advocate.

The whole podcast is worthwhile, but particularly the last 25 minutes (starting at about minute 40), in which Bhide discusses Schumpeterian vs Hayekian models of innovation, Knightian uncertainty, securitization and the financial crisis.

I would fault Bhide in one area: the catchy point of his recent book is that high level scientific breakthroughs (e.g., Archimedes' Principle of buoyancy) rapidly become public goods, whereas the nitty gritty skills and know-how necessary to create a useful product (e.g., shipbuilding) are more readily localized and the real source of competitive advantage. He focuses on small optimizations of existing technology to solve everyday problems; it's true that this is the more common type of innovation. But he neglects how whole new industries are sometimes created by real technological breakthroughs.

To take a particular example, look at the Fairchild Semiconductor guys. They weren't just average engineers -- they were trained in advanced labs and hired by the guy who actually invented the transistor (Shockley). It's no coincidence that the country that paid for the basic R&D went on to invent and capture the semiconductor industry. Of course, it was also necessary to have venture capital (actually, they sort of invented it), big capital markets and proximity to customers. But Bhide sounds like he wants to leave out the R&D aspect -- that can be done anywhere, he says. Yes, it can be done anywhere, but the commercialization is more likely to happen nearby, as long as the other necessary factors are also available. I could tell a similar story about biotech or internet companies in the bay area.

Basic research tends to be underfunded primarily because the inventor seldom captures the lion's share of future returns. This makes it less appealing to private investors compared to small optimizations (applications of existing technology) which lead more directly to products and profits. Therefore, funding for basic research must come from the public sector. Societies typically spend too little rather than too much, as future returns are diffuse and have no singular advocate.

Friday, February 13, 2009

Designer babies

Enhanced or unenhanced? You be the judge... From the episode Space Seed (trailer); full video.

McCoy: The Eugenics Wars of the 1990s.

Spock: Your attempt to improve the race by selective breeding.

McCoy: Oh no not our attempt, Mr. Spock. A group of ambitious scientists.

Soon to be outlawed? Probably not in Asia...

WSJ: Want a daughter with blond hair, green eyes and pale skin?

A Los Angeles clinic says it will soon help couples select both gender and physical traits in a baby when they undergo a form of fertility treatment. The clinic, Fertility Institutes, says it has received "half a dozen" requests for the service, which is based on a procedure called pre-implantation genetic diagnosis, or PGD.

While PGD has long been used for the medical purpose of averting life-threatening diseases in children, the science behind it has quietly progressed to the point that it could potentially be used to create designer babies. It isn't clear that Fertility Institutes can yet deliver on its claims of trait selection. But the growth of PGD, unfettered by any state or federal regulations in the U.S., has accelerated genetic knowledge swiftly enough that pre-selecting cosmetic traits in a baby is no longer the stuff of science fiction.

"It's technically feasible and it can be done," says Mark Hughes, a pioneer of the PGD process and director of Genesis Genetics Institute, a large fertility laboratory in Detroit. However, he adds that "no legitimate lab would get into it and, if they did, they'd be ostracized."

But Fertility Institutes disagrees. "This is cosmetic medicine," says Jeff Steinberg, director of the clinic that is advertising gender and physical trait selection on its Web site. "Others are frightened by the criticism but we have no problems with it."

PGD is a technique whereby a three-day-old embryo, consisting of about six cells, is tested in a lab to see if it carries a particular genetic disease. Embryos free of that disease are implanted in the mother's womb. Introduced in the 1990s, it has allowed thousands of parents to avoid passing on deadly disorders to their children.

...In a recent U.S. survey of 999 people who sought genetic counseling, a majority said they supported prenatal genetic tests for the elimination of certain serious diseases. The survey found that 56% supported using them to counter blindness and 75% for mental retardation.

More provocatively, about 10% of respondents said they would want genetic testing for athletic ability, while another 10% voted for improved height. Nearly 13% backed the approach to select for superior intelligence, according to the survey conducted by researchers at the New York University School of Medicine.

There are significant hurdles to any form of genetic enhancement. Most human traits are controlled by multiple genetic factors, and knowledge about their complex workings, though accelerating, is incomplete. And traits such as athleticism and intelligence are affected not just by DNA, but by environmental factors that cannot be controlled in a lab.

While many countries have banned the use of PGD for gender selection, it is permitted in the U.S. In 2006, a survey by the Genetics and Public Policy Center at Johns Hopkins University found that 42% of 137 PGD clinics offered a gender-selection service.

The science of PGD has steadily expanded its scope, often in contentious ways. Embryo screening, for example, is sometimes used to create a genetically matched "savior sibling" -- a younger sister or brother whose healthy cells can be harvested to treat an older sibling with a serious illness.

It also is increasingly used to weed out embryos at risk of genetic diseases -- such as breast cancer -- that could be treated, or that might not strike a person later in life. In 2007, the Bridge Centre fertility clinic in London screened embryos so that a baby wouldn't suffer from a serious squint that afflicted the father.

...For trait selection, a big hurdle is getting enough useful DNA material from the embryo. In a typical PGD procedure, a single cell is removed from a six-cell embryo and tested for the relevant genes or SNPs. It's relatively easy to check and eliminate diseases such as cystic fibrosis that are linked to a single malfunctioning gene. But to read the larger number of SNP markers associated with complex ailments such as diabetes, or traits like hair color, there often isn't enough high-quality genetic material.

William Kearns, a medical geneticist and director of the Shady Grove Center for Preimplantation Genetics in Rockville, Md., says he has made headway in cracking the problem. In a presentation made at a November meeting of the American Society of Human Genetics in Philadelphia, he described how he had managed to amplify the DNA available from a single embryonic cell to identify complex diseases and also certain physical traits.

Of 42 embryos tested, Dr. Kearns said he had enough data to identify SNPs that relate to northern European skin, hair and eye pigmentation in 80% of the samples. (A patent for Dr. Kearn's technique is pending; the test data are unpublished and have yet to be reviewed by other scientists.)

Dr. Kearns' talk attracted the attention of Dr. Steinberg, the head of Fertility Institutes, which already offers PGD for gender selection. The clinic had hoped to collaborate with Dr. Kearns to offer trait selection as well. In December, the clinic's Web site announced that couples who signed up for embryo screening would soon be able to make "a pre-selected choice of gender, eye color, hair color and complexion, along with screening for potentially lethal diseases."

Wednesday, February 11, 2009

The World's Greatest Economic Minds

Via Brad DeLong:

See also here:

Listen to this interview with former Goldman banker John Talbott for some refreshing straight talk (Leonard Lopate Show).

When a questioner suggested a summit of the nation's best economists, Krugman said something like: "We know what will happen if we bring together the greatest economic minds. It's spread across the blogosphere every day, and it's not pretty."

See also here:

Mr Krugman gives liberals the economics they want. Mr Barro gives conservatives the same service. They narrow or deny the common ground. Why does this matter? Because the views of readers inclined to one side or the other are further polarised; and in the middle, those of no decided allegiance conclude that economics is bunk.

Listen to this interview with former Goldman banker John Talbott for some refreshing straight talk (Leonard Lopate Show).

Tuesday, February 10, 2009

Robot Genius, PC Armor

The consumer version of the Robot Genius security client is now available, distributed by our partner DDT as the product PC Armor (PCA). It should be in a number of big box retailers (e.g., Staples) within the next 30 days. See PC Magazine review.

PCA is the only product on the market which compiles what we call a "causal history" of all events on a Windows machine. That is, the client can connect together events such as (t1 to t4 might be dates/times separated by seconds or months):

t1 game download / hidden malware install --->

t2 modified registry settings --->

t3 more components installed via hidden download --->

t4 etc. etc.

and *fully reverse* the consequences of just this chain of events. Our client monitors the Windows kernel, all processes on the system and all writes to the file system.

If PCA is installed on a new (or uninfected) machine, and the user never overrides one of our warnings, then we absolutely guarantee we can clean the machine and remove any malware (or other program) on the system, even months or years after the infection. Warnings are triggered only if a program attempts an action which might compromise our uninstall capability, like installing a driver (typical of a rootkit). However, the user will rarely see such warnings -- PCA is much quieter than existing security products.

Saturday, February 07, 2009

Ant algorithms

A review of E.O. Wilson's latest in The NY Review of Books. Ants seem to get a lot done based on a few simple capabilities: they can lay down odors, detect and differentiate those odors, and count.

In Surely You're Joking, Feynman recounts some great experiments he did on ants in his Princeton dorm room. See, e.g., here. My wife is totally uninterested when I do these types of things at home, but perhaps my kids will like it when they get a bit older :-)

In Surely You're Joking, Feynman recounts some great experiments he did on ants in his Princeton dorm room. See, e.g., here. My wife is totally uninterested when I do these types of things at home, but perhaps my kids will like it when they get a bit older :-)

...However, ants clearly are fundamentally different from us. A whimsical example concerns the work of ant morticians, which recognize ant corpses purely on the basis of the presence of a product of decomposition called oleic acid. When researchers daub live ants with the acid, they are promptly carried off to the ant cemetery by the undertakers, despite the fact that they are alive and kicking. Indeed, unless they clean themselves very thoroughly they are repeatedly dragged to the mortuary, despite showing every other sign of life.

The means that ants use to find their way in the world are fascinating. It has recently been found that ant explorers count their steps to determine where they are in relation to home. This remarkable ability was discovered by researchers who lengthened the legs of ants by attaching stilts to them. The stilt-walking ants, they observed, became lost on their way home to the nest at a distance proportionate to the length of their stilts.

The principal tools ants use, however, in guiding their movements and actions are potent chemical signals known as pheromones. ...

One can hardly help but admire the intelligence of the ant colony, yet theirs is an intelligence of a very particular kind. "Nothing in the brain of a worker ant represents a blueprint of the social order," Hölldobler and Wilson tell us, and there is no overseer or "brain caste" that carries such a master plan in its head. Instead, the ants have discovered how to create strength from weakness, by pooling their individually limited capacities into a collective decision-making system that bears an uncanny resemblance to our own democratic processes.

[How peculiar is it? Just replace the word "ant" by "cell" or "neuron" or something like that. Unless you don't believe in AI ;-)]

This capacity is perhaps most clearly illustrated when an ant colony finds reason to move. Many ants live in cavities in trees or rocks, and the size, temperature, humidity, and precise form and location of the chamber are all critically important to the success of the superorganism. Individual ants appear to size up the suitability of a new cavity using a rule of thumb called Buffon's needle algorithm. They do this by laying a pheromone trail across the cavity that is unique to that individual ant, then walking about the space for a given period of time. The more often they cross their own trail, the smaller the cavity is.

This yields only a rough measure of the cavity's size, for some ants using it may choose cavities that are too large, and others will choose cavities that are too small. The cavity deemed most suitable by the majority, however, is likely to be the best. The means employed by the ants to "count votes" for and against a new cavity is the essence of elegance and simplicity, for the cavity visited by the most ants has the strongest pheromone trail leading to it, and it is in following this trail that the superorganism makes its collective decision.

Thursday, February 05, 2009

Liam Casey on BBC

Here's a BBC podcast on expat Irish entrepreneur Liam Casey.

Casey was James Fallows' guide to the Chinese manufacturing economy in this article in the Atlantic. Shortly after reading the article I met Casey at Foo Camp. He's surprisingly quiet and low-key given his career path -- not the bombastic entrepreneur that you'd expect, but instead quite thoughtful.

At the end of the podcast Casey takes the interviewer to see the new public library in downtown Shenzen (beautiful flickr photo set here), which he views as emblematic of the future of China. His comments remind me of what I wrote in my earlier post on the Fallows article:

BBC: Few westerners understand Chinese business better than Liam Casey. From his base in the industrial powerhouse of Shenzen close to Hong Kong, he gave Peter Day a stream of insights into how China works … and how its influence is rippling through companies and consumers all over the world.

Casey was James Fallows' guide to the Chinese manufacturing economy in this article in the Atlantic. Shortly after reading the article I met Casey at Foo Camp. He's surprisingly quiet and low-key given his career path -- not the bombastic entrepreneur that you'd expect, but instead quite thoughtful.

At the end of the podcast Casey takes the interviewer to see the new public library in downtown Shenzen (beautiful flickr photo set here), which he views as emblematic of the future of China. His comments remind me of what I wrote in my earlier post on the Fallows article:

I first visited Shenzhen on a day trip from Hong Kong in the early 90's. I was excited to see it, since it was one of the first Special Economic Zones (SEZ) set up by the communist government. My friends in HK couldn't understand why I would want to visit -- they suggested scenic Guilin instead. But I was already fascinated by the rapid economic changes taking place; I wanted to see China's future, not its past. At the time, everything was rough: roads were terrible, new buildings had no sidewalks or landscaping, our bus was caught in some of the worst traffic jams I have ever seen. Now you can take the subway/train there directly from HK, there are 8 million residents, and (I'm told) the city is full of parks and green spaces.

On $500k a year

Hmm... after tax, that's barely above the carrying cost for a family of 4 in Manhattan -- assuming the usual private schools and a typical banker's wife ;-) See here for detailed accounting -- warning, may perturb your hedonic treadmill :-)

I understand the pay caps don't limit incentive stock option compensation. Perhaps that leaves some wiggle room, depending on what people think about the future value of bank shares (and modulo the inevitable nationalization we keep putting off). You certainly have to apply a deep discount relative to cash.

Some individuals are going to hop to foreign and smaller banks which are unencumbered by pay caps, or to hedge funds and money management firms. But I doubt job hopping is very easy for most employees right now, so I suspect this pay cap isn't going to hurt the banks that much (certainly far less than they've hurt themselves recently!), at least until conditions start to improve.

I'm interested in opinions from people on the Street, though :-)

I understand the pay caps don't limit incentive stock option compensation. Perhaps that leaves some wiggle room, depending on what people think about the future value of bank shares (and modulo the inevitable nationalization we keep putting off). You certainly have to apply a deep discount relative to cash.

Some individuals are going to hop to foreign and smaller banks which are unencumbered by pay caps, or to hedge funds and money management firms. But I doubt job hopping is very easy for most employees right now, so I suspect this pay cap isn't going to hurt the banks that much (certainly far less than they've hurt themselves recently!), at least until conditions start to improve.

I'm interested in opinions from people on the Street, though :-)

Tuesday, February 03, 2009

US car sales fall below China’s for first time

Hard to believe... the Financial Times has the story.

The times they are a changing...

FT: Annualised US car sales slipped below 10m last month – and were less than China’s for the first time – in spite of steep discounts offered by carmakers and government efforts to ease lending.

...GM estimated the overall annualised selling rate for cars at 9.8m in the US in January, compared with 10.3m in December, and less than China’s estimated selling rate of 10.7m last month.

The times they are a changing...

Zheng He (Wikipedia): ...Zheng He commanded seven expeditions. The 1405 expedition consisted of 27,800 men and a fleet of 62 treasure ships supported by approximately 190 smaller ships. The fleet included ... Treasure ships, used by the commander of the fleet and his deputies (nine-masted, about 126.73 meters (416 ft) long and 51.84 metres (170 ft) wide), according to later writers. ... The treasure ships purportedly can carry as much as 1,500 tons. By way of comparison, a modern ship of about 1,200 tons is 60 meters (200 ft) long, and the ships Christopher Columbus sailed to the New World in 1492 were about 70-100 tons and 17 meters (55 ft) long.

Comment moderation

FYI, I reserve the right to delete comments that I feel are objectionable.

Also, keep in mind I can see your IP address.

Also, keep in mind I can see your IP address.

How they actually MAKE the money

A few years ago I corresponded with anti-neoclassical economist Steve Keen about his book Debunking Economics. It's not easy to classify Keen's viewpoint -- he is neither a neoclassical nor a Marxist nor even a standard "heterodox" thinker.

In this article Keen discusses how, in the modern financial system, credit markets determine the supply of money. I mentioned the same issue in my talk on the financial crisis (slide labeled Leverage). Allowing people to borrow from the future means that the money supply at any moment is a complicated function of beliefs about risk, uncertainty, the future, etc.

By clicking through to the article, you can also find out who wrote the following:

Based on his nonstandard view of money and the money supply, Keen identifies four big problems for Bernanke:

In this article Keen discusses how, in the modern financial system, credit markets determine the supply of money. I mentioned the same issue in my talk on the financial crisis (slide labeled Leverage). Allowing people to borrow from the future means that the money supply at any moment is a complicated function of beliefs about risk, uncertainty, the future, etc.

By clicking through to the article, you can also find out who wrote the following:

“Talk about centralisation! The credit system, which has its focus in the so-called national banks and the big money-lenders and usurers surrounding them, constitutes enormous centralisation, and gives this class of parasites the fabulous power, not only to periodically despoil industrial capitalists, but also to interfere in actual production in a most dangerous manner— and this gang knows nothing about production and has nothing to do with it.”

Based on his nonstandard view of money and the money supply, Keen identifies four big problems for Bernanke:

1. Banks won’t create more credit money as a result of the injections of Base Money. Instead, inactive reserves will rise

2. Creating more credit money requires a matching increase in debt—even if the money multiplier model were correct, what would the odds be of the private sector taking on an additional US$7 trillion in debt in addition to the current US$42 trillion it already owes?

3. Deflation will continue because the motive force behind it will still be there—distress selling by retailers and wholesalers who are desperately trying to avoid going bankrupt

4. The macroeconomic process of deleveraging will reduce real demand no matter what is done, as Microsoft CEO Steve Ballmer recently noted: “We’re certainly in the midst of a once-in-a-lifetime set of economic conditions. The perspective I would bring is not one of recession. Rather, the economy is resetting to lower level of business and consumer spending based largely on the reduced leverage in economy”

Power laws, baby

Thanks to reader GS for the link to this excellent article by statistical physicist Eugene Stanley. There's much more to the article, but I decided to excerpt this discussion of security price fluctuations and the observation that they are far from log normal.

Stanley: ...

When they analyzed these data–200 million of them–in exactly the same fashion that Bachelier had analyzed data almost a century earlier, they made a startling discovery. The pdf of price changes was not Gaussian plus outliers, as previously believed. Rather, all the data–including data previously termed outliers–conformed to a single pdf encompassing both everyday fluctuations and “once in a century” fluctuations. Instead of a Gaussian or some correction to a Gaussian, they found a power law pdf with exponent -4, a sufficiently large exponent that the difference from a Gaussian is not huge; however, the probability of a “once in a century” event of, say, 100 standard deviations is exp(-10,000) for the Gaussian, but simply 10-8 for an inverse quartic law. If one analyzes a data set containing 200 million data in two years, this means there are only two such events–in two years!

Now which is better, the concept of “everyday fluctuations” which can be modeled with a drunkard’s walk, complemented by a few “once in a century” outliers? Or a single empirical law with no outliers but for which a complete theory does not exist despite promising progress by Xavier Gabaix of NYU’s Stern School of Management and his collaborators? Here we come to one of the most salient differences between traditional economics and the econophysicists: economists are hesitant to put much stock in laws that have no coherent and complete theory supporting them, while physicists cannot afford this reluctance. There are so many phenomena we do not understand. Indeed, many physics “laws” have proved useful long before any theoretical underpinning was developed . . . Newton’s laws and Coulomb’s law to name but two.

And all of us are loathe to accept even a well-documented empirical law that seems to go against our own everyday experience. For stock price fluctuations, we all experience calm periods of everyday fluctuations, punctuated by highly volatile periods that seem to cluster. So we would expect the pdf of stock price fluctuations to be bimodal, with a broad maximum centered around, say, 1-3 standard deviations and then a narrow peak centered around, say, 50 standard deviations. And it is easy to show that if we do not have access to “all the data” but instead sample only a small fraction of the 200 million data recently analyzed, then this everyday experience is perfectly correct, since the rare events are indeed rare and we barely recall those that are “large but not that large”.

The same is true for earthquakes: our everyday experience teaches us that small quakes are going on all the time but are barely noticeable except by those who work at seismic detection stations. And every so often occurs a “once in a century” truly horrific event, such as the famous San Francisco earthquake. Yet when seismic stations analyze all the data, they find not the bimodal distribution of everyday experience but rather a power law, the Gutenberg-Richter law, describing the number of earthquakes of a given magnitude.

Monday, February 02, 2009

Markets overshoot on the downside, too

Finance, now oversold?

Wall Street's New Pariah Status (NYTimes):

...

As money and prestige drain out of Wall Street, and as layoffs mount, other careers are starting to seem more appealing. Mr. Chen [former Bear VP] has helped start a retail company, GreenSoul Shoes, that sells sandals made by Cambodian villagers out of discarded rubber tires.

...

Robert J. Birnbaum, the former president of the New York Stock Exchange, sees an upside to Wall Street’s diminished reputation.

“It’s taken a hit, but so what?” he said. “We don’t need all the bright people going to Wall Street, chasing money. There’s a lot of things bright people can do. Like find a cure for cancer.”

Subscribe to:

Posts (Atom)

Blog Archive

-

▼

2009

(204)

-

▼

02

(21)

- Deprogramming the cult of the Efficient Market

- Trento talk

- Innovation competitiveness

- Macro graphs

- David X. Li

- Demand destruction

- Netbooks and tipping points

- Heritability of brain structure

- Race and IQ in Nature

- Bhide, innovation and basic research

- Designer babies

- The World's Greatest Economic Minds

- Robot Genius, PC Armor

- Ant algorithms

- Liam Casey on BBC

- On $500k a year

- US car sales fall below China’s for first time

- Comment moderation

- How they actually MAKE the money

- Power laws, baby

- Markets overshoot on the downside, too

-

▼

02

(21)

Labels

- physics (420)

- genetics (325)

- globalization (301)

- genomics (295)

- technology (282)

- brainpower (280)

- finance (275)

- american society (261)

- China (249)

- innovation (231)

- ai (206)

- economics (202)

- psychometrics (190)

- science (172)

- psychology (169)

- machine learning (166)

- biology (163)

- photos (162)

- genetic engineering (150)

- universities (150)

- travel (144)

- podcasts (143)

- higher education (141)

- startups (139)

- human capital (127)

- geopolitics (124)

- credit crisis (115)

- political correctness (108)

- iq (107)

- quantum mechanics (107)

- cognitive science (103)

- autobiographical (97)

- politics (93)

- careers (90)

- bounded rationality (88)

- social science (86)

- history of science (85)

- realpolitik (85)

- statistics (83)

- elitism (81)

- talks (80)

- evolution (79)

- credit crunch (78)

- biotech (76)

- genius (76)

- gilded age (73)

- income inequality (73)

- caltech (68)

- books (64)

- academia (62)

- history (61)

- intellectual history (61)

- MSU (60)

- sci fi (60)

- harvard (58)

- silicon valley (58)

- mma (57)

- mathematics (55)

- education (53)

- video (52)

- kids (51)

- bgi (48)

- black holes (48)

- cdo (45)

- derivatives (43)

- neuroscience (43)

- affirmative action (42)

- behavioral economics (42)

- economic history (42)

- literature (42)

- nuclear weapons (42)

- computing (41)

- jiujitsu (41)

- physical training (40)

- film (39)

- many worlds (39)

- quantum field theory (39)

- expert prediction (37)

- ufc (37)

- bjj (36)

- bubbles (36)

- mortgages (36)

- google (35)

- race relations (35)

- hedge funds (34)

- security (34)

- von Neumann (34)

- meritocracy (31)

- feynman (30)

- quants (30)

- taiwan (30)

- efficient markets (29)

- foo camp (29)

- movies (29)

- sports (29)

- music (28)

- singularity (27)

- entrepreneurs (26)

- conferences (25)

- housing (25)

- obama (25)

- subprime (25)

- venture capital (25)

- berkeley (24)

- epidemics (24)

- war (24)

- wall street (23)

- athletics (22)

- russia (22)

- ultimate fighting (22)

- cds (20)

- internet (20)

- new yorker (20)

- blogging (19)

- japan (19)

- scifoo (19)

- christmas (18)

- dna (18)

- gender (18)

- goldman sachs (18)

- university of oregon (18)

- cold war (17)

- cryptography (17)

- freeman dyson (17)

- smpy (17)

- treasury bailout (17)

- algorithms (16)

- autism (16)

- personality (16)

- privacy (16)

- Fermi problems (15)

- cosmology (15)

- happiness (15)

- height (15)

- india (15)

- oppenheimer (15)

- probability (15)

- social networks (15)

- wwii (15)

- fitness (14)

- government (14)

- les grandes ecoles (14)

- neanderthals (14)

- quantum computers (14)

- blade runner (13)

- chess (13)

- hedonic treadmill (13)

- nsa (13)

- philosophy of mind (13)

- research (13)

- aspergers (12)

- climate change (12)

- harvard society of fellows (12)

- malcolm gladwell (12)

- net worth (12)

- nobel prize (12)

- pseudoscience (12)

- Einstein (11)

- art (11)

- democracy (11)

- entropy (11)

- geeks (11)

- string theory (11)

- television (11)

- Go (10)

- ability (10)

- complexity (10)

- dating (10)

- energy (10)

- football (10)

- france (10)

- italy (10)

- mutants (10)

- nerds (10)

- olympics (10)

- pop culture (10)

- crossfit (9)

- encryption (9)

- eugene (9)

- flynn effect (9)

- james salter (9)

- simulation (9)

- tail risk (9)

- turing test (9)

- alan turing (8)

- alpha (8)

- ashkenazim (8)

- data mining (8)

- determinism (8)

- environmentalism (8)

- games (8)

- keynes (8)

- manhattan (8)

- new york times (8)

- pca (8)

- philip k. dick (8)

- qcd (8)

- real estate (8)

- robot genius (8)

- success (8)

- usain bolt (8)

- Iran (7)

- aig (7)

- basketball (7)

- free will (7)

- fx (7)

- game theory (7)

- hugh everett (7)

- inequality (7)

- information theory (7)

- iraq war (7)

- markets (7)

- paris (7)

- patents (7)

- poker (7)

- teaching (7)

- vietnam war (7)

- volatility (7)

- anthropic principle (6)

- bayes (6)

- class (6)

- drones (6)

- econtalk (6)

- empire (6)

- global warming (6)

- godel (6)

- intellectual property (6)

- nassim taleb (6)

- noam chomsky (6)

- prostitution (6)

- rationality (6)

- academia sinica (5)

- bobby fischer (5)

- demographics (5)

- fake alpha (5)

- kasparov (5)

- luck (5)

- nonlinearity (5)

- perimeter institute (5)

- renaissance technologies (5)

- sad but true (5)

- software development (5)

- solar energy (5)

- warren buffet (5)

- 100m (4)

- Poincare (4)

- assortative mating (4)

- bill gates (4)

- borges (4)

- cambridge uk (4)

- censorship (4)

- charles darwin (4)

- computers (4)

- creativity (4)

- hormones (4)

- humor (4)

- judo (4)

- kerviel (4)

- microsoft (4)

- mixed martial arts (4)

- monsters (4)

- moore's law (4)

- soros (4)

- supercomputers (4)

- trento (4)

- 200m (3)

- babies (3)

- brain drain (3)

- charlie munger (3)

- cheng ting hsu (3)

- chet baker (3)

- correlation (3)

- ecosystems (3)

- equity risk premium (3)

- facebook (3)

- fannie (3)

- feminism (3)

- fst (3)

- intellectual ventures (3)

- jim simons (3)

- language (3)

- lee kwan yew (3)

- lewontin fallacy (3)

- lhc (3)

- magic (3)

- michael lewis (3)

- mit (3)

- nathan myhrvold (3)

- neal stephenson (3)

- olympiads (3)

- path integrals (3)

- risk preference (3)

- search (3)

- sec (3)

- sivs (3)

- society generale (3)

- systemic risk (3)

- thailand (3)

- twitter (3)

- alibaba (2)

- bear stearns (2)

- bruce springsteen (2)

- charles babbage (2)

- cloning (2)

- david mamet (2)

- digital books (2)

- donald mackenzie (2)

- drugs (2)

- dune (2)

- exchange rates (2)

- frauds (2)

- freddie (2)

- gaussian copula (2)

- heinlein (2)

- industrial revolution (2)

- james watson (2)

- ltcm (2)

- mating (2)

- mba (2)

- mccain (2)

- monkeys (2)

- national character (2)

- nicholas metropolis (2)

- no holds barred (2)

- offices (2)

- oligarchs (2)

- palin (2)

- population structure (2)

- prisoner's dilemma (2)

- singapore (2)

- skidelsky (2)

- socgen (2)

- sprints (2)

- star wars (2)

- ussr (2)

- variance (2)

- virtual reality (2)

- war nerd (2)

- abx (1)

- anathem (1)

- andrew lo (1)

- antikythera mechanism (1)

- athens (1)

- atlas shrugged (1)

- ayn rand (1)

- bay area (1)

- beats (1)

- book search (1)

- bunnie huang (1)

- car dealers (1)

- carlos slim (1)

- catastrophe bonds (1)

- cdos (1)

- ces 2008 (1)

- chance (1)

- children (1)

- cochran-harpending (1)

- cpi (1)

- david x. li (1)

- dick cavett (1)

- dolomites (1)

- eharmony (1)

- eliot spitzer (1)

- escorts (1)

- faces (1)

- fads (1)

- favorite posts (1)

- fiber optic cable (1)

- francis crick (1)

- gary brecher (1)

- gizmos (1)

- greece (1)

- greenspan (1)

- hypocrisy (1)

- igon value (1)

- iit (1)

- inflation (1)

- information asymmetry (1)

- iphone (1)

- jack kerouac (1)

- jaynes (1)

- jazz (1)

- jfk (1)

- john dolan (1)

- john kerry (1)

- john paulson (1)

- john searle (1)

- john tierney (1)

- jonathan littell (1)

- las vegas (1)

- lawyers (1)

- lehman auction (1)

- les bienveillantes (1)

- lowell wood (1)

- lse (1)

- machine (1)

- mcgeorge bundy (1)

- mexico (1)

- michael jackson (1)

- mickey rourke (1)

- migration (1)

- money:tech (1)

- myron scholes (1)

- netwon institute (1)

- networks (1)

- newton institute (1)

- nfl (1)

- oliver stone (1)

- phil gramm (1)

- philanthropy (1)

- philip greenspun (1)

- portfolio theory (1)

- power laws (1)

- pyschology (1)

- randomness (1)

- recession (1)

- sales (1)

- skype (1)

- standard deviation (1)

- starship troopers (1)

- students today (1)

- teleportation (1)

- tierney lab blog (1)

- tomonaga (1)

- tyler cowen (1)

- venice (1)

- violence (1)

- virtual meetings (1)

- wealth effect (1)